Sugar Talk

Sugar Talk

Global sugar market report: November 2025

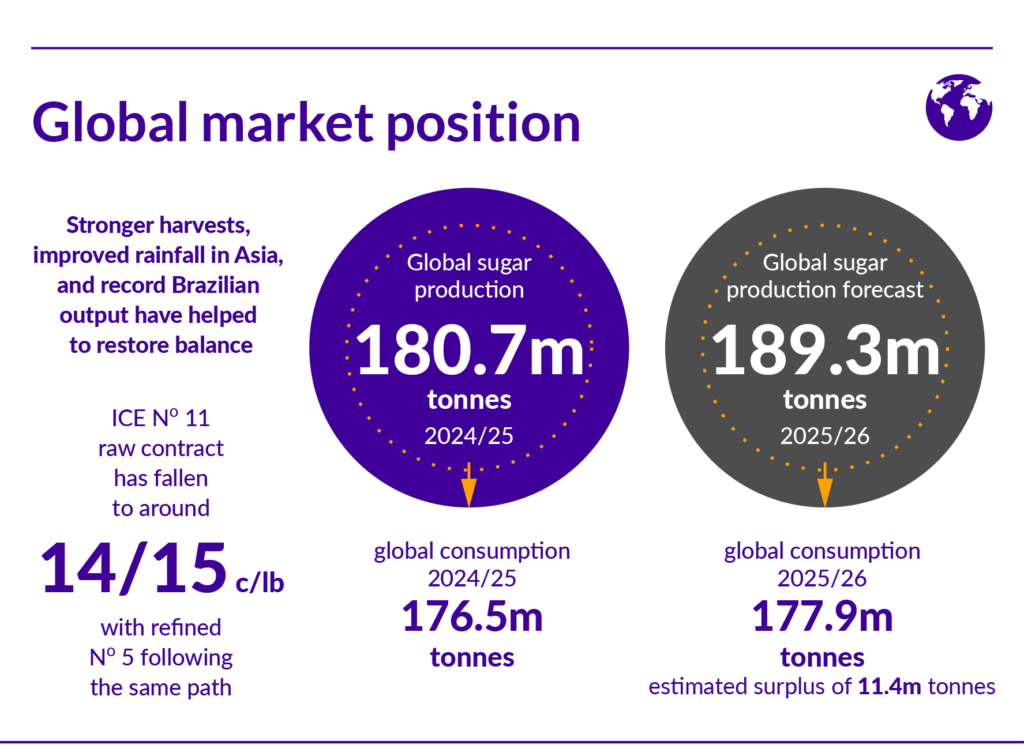

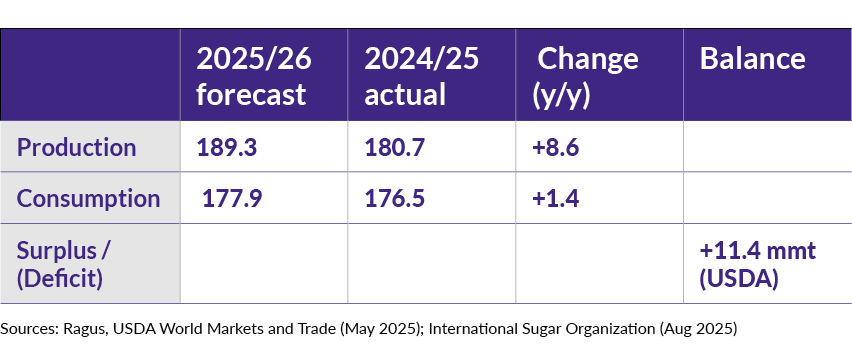

Global sugar markets have reset after two volatile years. A combination of stronger harvests, improved rainfall in Asia, and record Brazilian output has restored balance to a market that was in deficit through 2023/24. However, prices remain sensitive to crude oil and ethanol dynamics: when oil prices rise, mills divert more cane to ethanol; when oil weakens, more cane flows into sugar. As crude has softened through 2025 and global ethanol demand slowed, sugar supply has risen.

Overview: stability or further volatility?

After two turbulent seasons marked by weather extremes and energy-driven volatility, global sugar markets have steadied in 2025. Benchmark prices have reset lower: the ICE No.11 raw contract has fallen to around 14–15 c/lb, with refined No.5 following the same path. The correction reflects abundant cane supply, easing oil prices, and the stabilising influence of improved weather in key producing regions.

Global macroeconomic headwinds also play a role. Slowing industrial activity in China, moderate GDP growth in Europe, and lower fuel demand have reduced pressure on ethanol markets. When crude oil prices fall, mills divert more cane to sugar rather than ethanol, which is exactly what we’ve seen this year in Brazil and, to a lesser extent, India. The result is a surge in sugar availability and a flattening of forward price curves.

Climatic conditions have been far less disruptive than in the previous cycle. The El Niño that constrained Asian production in 2023 has transitioned to neutral, bringing steadier rainfall across Thailand, India and southern China. Brazil’s Centre-South region has enjoyed one of its most favourable seasons in recent memory, with consistently high ATR and an extended crush.

Shipping has also improved: global freight rates have eased from 2024 peaks, though Red Sea detours continue to affect voyage times into Europe.

For consumers, inflation has cooled in most regions, but demand growth remains modest. In many developing markets, population growth keeps sugar consumption trending upward, offsetting slower usage in mature economies where health and labelling policies continue to limit per-capita intake.

European Union output falls

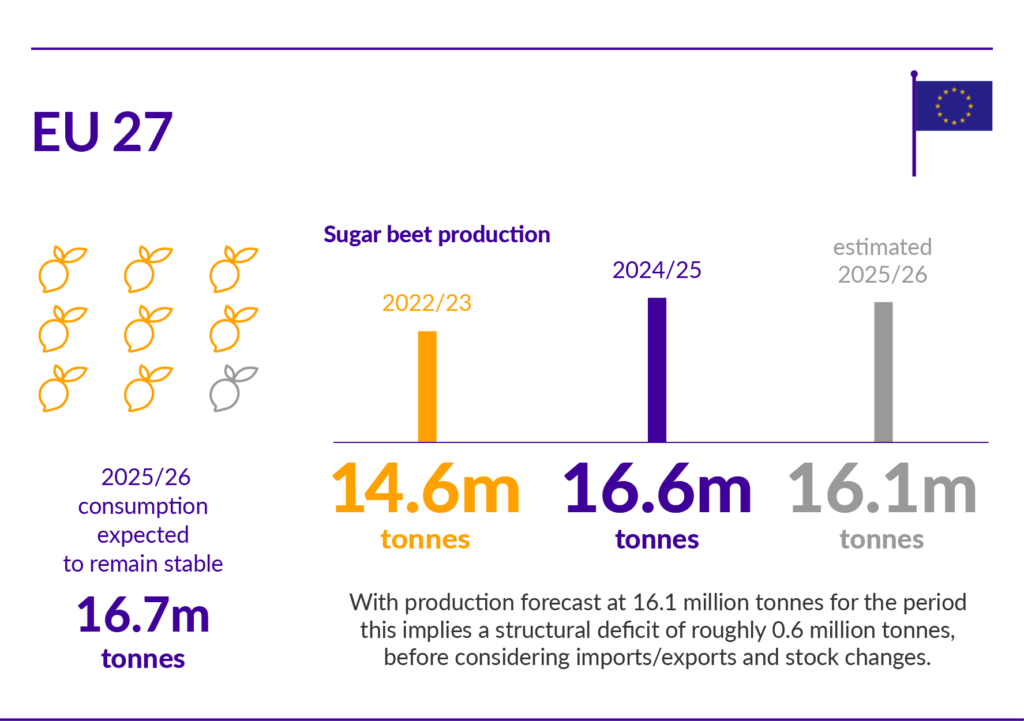

The European Union (EU) beet area under cultivation across those of its 27 members (EU27) that farm sugar beet has contracted, leading to a predicted fall in output. However, the reduction has been mitigated by better than expected yields resulting from favourable weather. The 2025/26 EU beet sugar forecast now stands at 16.1 million tonnes, down from 16.6 million tonnes in 2024/25 and 14.6 million tonnes produced in 2022/23.

According to the USDA FAS (US Department of Agriculture Foreign Agricultural Service) EU sugar consumption in 2025/26 is “expected to remain stable” at 16.7 million tonnes. With production forecast at 16.1 million tonnes for the period this implies a structural deficit of roughly 0.6 million tonnes, before considering imports/exports and stock changes.

Prices across the bloc have softened during 2025 from their 2024 highs as cheaper global raws filtered in but remain above long-term averages due to high energy and freight costs. The EU’s emergency brake on Ukrainian imports, reimposing quotas and duties from mid-2024, continues to limit inflows and helped stabilise internal markets. Revised quota ceilings announced in July 2025 will curb white sugar imports from Ukraine further next year, supporting a modest regional premium.

Steady domestic beet and stable policy keep the UK market balanced

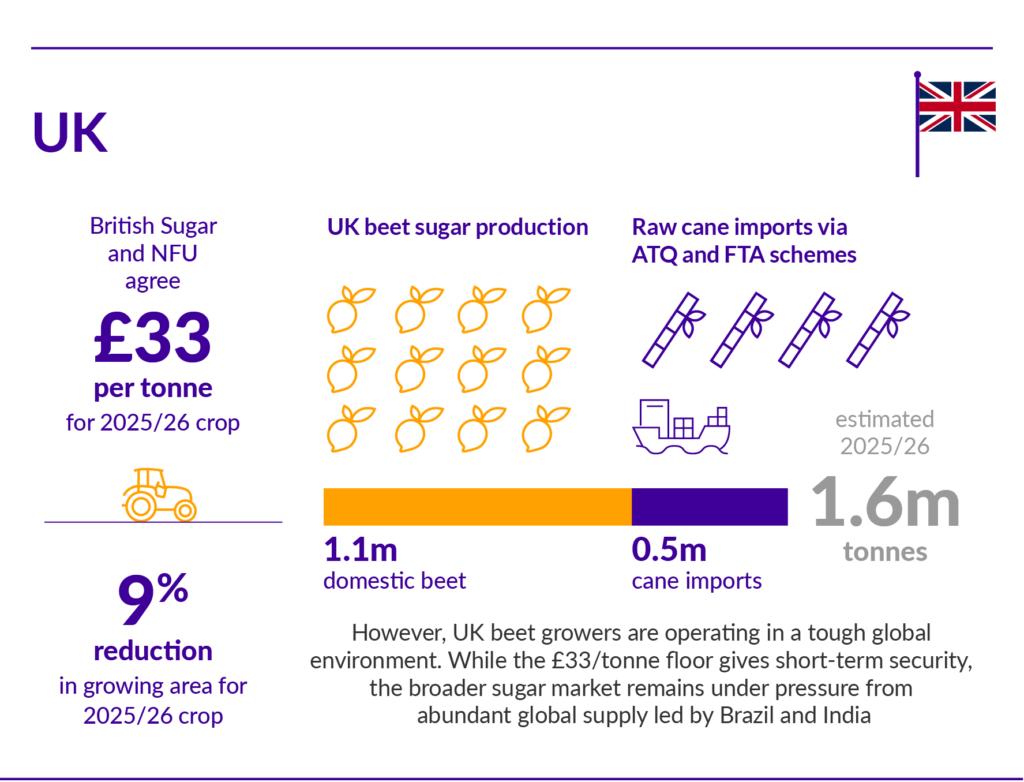

From the latest contract data for crop 2025/26, a fixed-price contract at £33/tonne for up to 70% of the contract tonnage has been agreed for farmers. The NFU reported 9% reduction in growing area for the 2025/26 crop, with the 2025/26 campaign opened in mid-September across the East Of England and Midlands. Favourable weather is expected to lift yields slightly, supporting domestic UK output of around 1.1 million tonnes.

Assuming this UK domestic beet supply of 1.1 million tonnes is accurate, plus raw cane imports via the ATQ and FTA schemes of 0.5-0.6 million tonnes imported as raw cane then refined, this gives estimated total UK supply of around 1.5-1.7 million tonnes from beet and cane. If UK consumption is broadly similar, as limited historical data suggests, in the 1.7-1.8 million tonne range, UK is in near balance, but with limited import margin.

Policy stability remains a cornerstone of UK supply. The 260,000-tonne raw-cane ATQ stays in place for 2025, and the Australia–UK FTA quota increased to 120,000 tonnes this year. Together these arrangements give UK refiners and manufacturers access to competitively priced raws, mitigating global volatility.

With domestic beet constrained by capacity and crop rotation limits, imports remain essential. Together they ensure secure access to competitively priced raws. Falling world prices and a stable pound have created good buying conditions for early-2026 coverage, though channel logistics remain tight.

However, UK beet growers are operating in a tough global environment. While the £33/tonne floor for 2025/26 gives short-term security, the broader sugar market remains under pressure from abundant global supply led by Brazil and India (see below), depressed EU beet production, and flat consumption in mature markets.

The £30/tonne expectation for 2026/27 signals that cost pressures from inputs, energy and environmental regulation are likely to squeeze margins unless supply tightens or prices recover. For buyers and processors, this means UK beet sugar remains competitively priced, but the modest margin means any significant cost increase or supply disruption from weather or logistics could reduce flexibility.

Russia and Ukraine look inwards and regionally

Ukraine’s 2025/26 beet sugar output is estimated at 1.5 million tonnes, down from 1.8 million tonnes a year earlier. The continuation of EU import quotas has redirected some Ukrainian exports toward neighbouring CIS markets and North Africa.

For Russia, reliable public forecasts are still pending. Domestic production in 2024/25 was around 5.9 million tonnes, and early indications suggest a similar volume this season. Domestic demand is steady, though logistics and currency volatility continue to shape trade routes.

South American surplus dominates global supply and pricing

Brazil remains the pivotal force in global sugar. The 2025/26 crush is forecast at 44.7 million tonnes of sugar, up 2.7 million tonnes year-on-year. High total recoverable sugar readings and favourable weather have extended the crush, with the sugar mix averaging close to 48%. Ethanol parity has weakened with lower crude prices, encouraging mills to allocate more cane to sugar production.

Exports of 35.8 million tonnes are expected, maintaining Brazil’s position as the world’s largest supplier.

Argentina and Colombia both contribute small year-on-year gains. Argentina’s production is 1.88 million tonnes, while Colombia produces about 2.3 million tonnes, a 2% increase on 2024/25 production, with ethanol output rising 3-4 % to approximately 420 million litres. In Colombia, this flexible cane allocation between ethanol and sugar helps balance domestic and export markets. Both countries benefit from stable domestic markets and steady regional demand for refined product.

Chile, once a beet producer, now relies heavily on imports. Around 250,000 tonnes of refined sugar are expected to arrive from Argentina in 2025/26, keeping Chile’s market well supplied despite domestic contraction. Chile will continue to prioritise supply security and quality over price, favouring nearby origins.

This means South America as a whole is in surplus. Brazil’s record output alone accounts for nearly a quarter of global supply, setting the tone for prices worldwide. Argentina, Colombia and Chile collectively add marginal tonnage and logistical resilience for regional buyers.

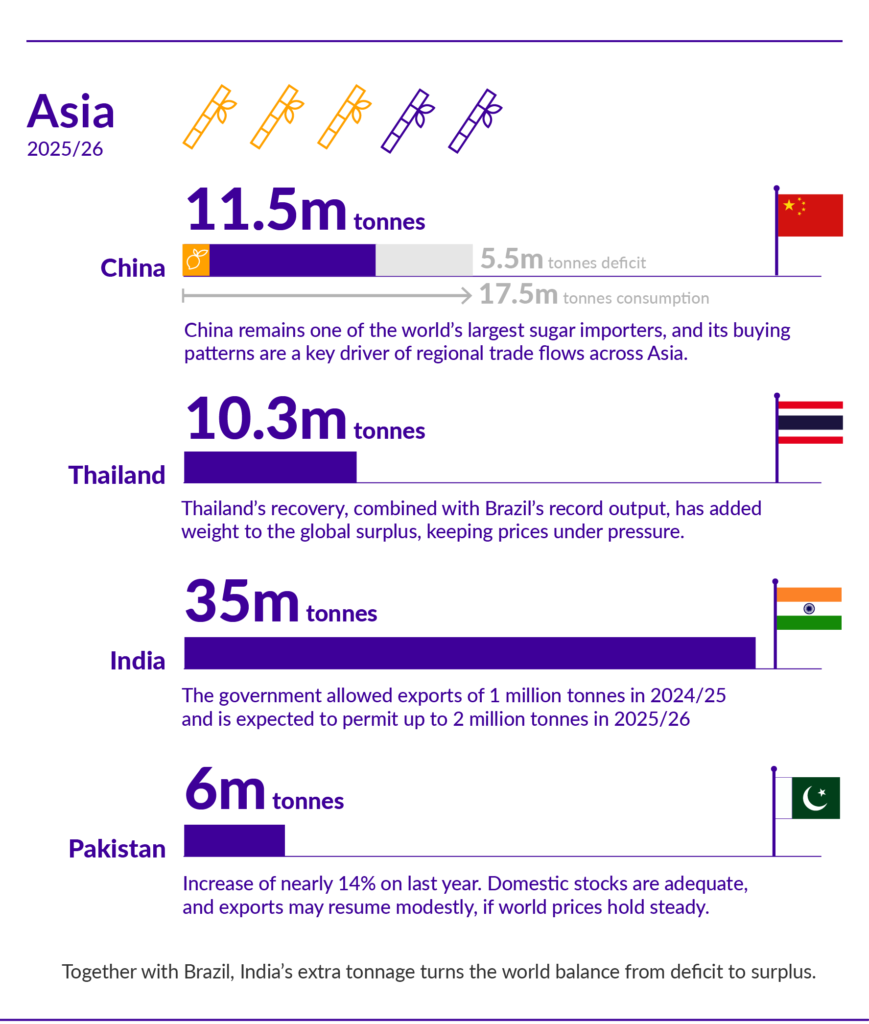

Asia in surplus despite China remaining structurally short of sugar

China’s sugar market is entering 2025/26 on a more stable footing after two erratic seasons shaped by drought in Yunnan, excess rain in Guangxi and a disruptive El Niño pattern across southern provinces. Weather conditions have normalised during 2024/25, lifting cane yields and supporting a modest recovery in beet areas across Xinjiang and Inner Mongolia.

For 2025/26, China’s total sugar production is forecast at around 11.5 million tonnes, a slight increase on the previous season. USDA’s latest estimates place cane sugar at approximately 9.9 million tonnes and beet sugar at around 1.6 million tonnes, reflecting stable cane yields in Guangxi and Yunnan and cautious growth in beet plantings after input cost pressures last year.

Consumption remains structurally high. China’s sugar use is expected to hold around 17.0–17.5 million tonnes in 2025/26, driven by continued growth in food service, soft drinks, and processed foods even as per-capita consumption plateaus. Although economic growth has slowed, urban food demand remains robust and substitution toward alternative sweeteners has not materially dented traditional sugar use.

This leaves China with a significant structural deficit of roughly 5.5–6.0 million tonnes, which must be met through imports of both raws and refined sugar. Brazil continues to dominate import supply, with Thailand’s recovery adding regional availability. Laos and Vietnam also feature increasingly in cross-border cane and sugar sourcing, particularly where Chinese mills process imported cane for domestic use.

Import sentiment in 2025/26 is also shaped by China’s regulatory approach: the continued ban on Thai “border-syrup” shipments has reduced grey-channel flows into beverage and food manufacturers, shifting demand back toward formal tariff-rate quota imports and bonded warehouse channels.

China remains one of the world’s largest sugar importers, and its buying patterns are a key driver of regional trade flows across Asia. A stable production year helps offset global volatility, but the structural gap between domestic output and consumption ensures China will keep drawing heavily on world supply in 2025/26. For exporters, strong Brazilian availability and improving Thai output will help meet China’s needs, while the country’s regulatory stance on syrups and substitutes continues to support demand for standard raws and refined sugar.

Thailand recovers from drought and is seeking new export markets

After two years of drought, with farmers choosing different crops that use less water, Thailand’s cane sector has recovered strongly. The 2024/25 crop rebounded 14% to 10 million tonnes, and the USDA projects 10.3 million tonnes for 2025/26. Weather has improved across the northeast, and higher cane prices have encouraged planting.

However, China’s continued ban on Thai sugar-syrup imports, in place since December 2024, has reduced demand from processors targeting the Chinese beverage industry. Exporters are compensating by expanding direct raw and refined sugar sales to regional markets.

Thailand’s recovery, combined with Brazil’s record output, has added weight to the global surplus, keeping prices under pressure.

Growth in output places India and Pakistan as key global price influencers

India’s sugar output is projected at 35 million tonnes, up from 32.8 million tonnes last year, driven by better monsoon rains and a partial diversion of ethanol-bound cane back into sugar. The government allowed exports of 1 million tonnes in 2024/25 and is expected to permit up to 2 million tonnes in 2025/26 if domestic stocks remain comfortable. Policy decisions here will strongly influence world prices.

The export policy decision will be crucial: full approval could release a significant tonnage onto the world market, adding to downward price pressure, while tighter restrictions would stabilise No.11 futures.

In Pakistan, production is forecast at 6.6 million tonnes, up nearly 14% on last year, supported by expanded cane area and improved irrigation. Domestic stocks are adequate, and exports may resume modestly if world prices hold steady.

The subcontinent’s rebound potentially transforms global dynamics. Together with Brazil, India’s extra tonnage turns the world balance from deficit to surplus. Yet policy uncertainty over exports keeps risk premiums alive.

Laos offers buyers options as a new origin

In addition to the big Asian producers, Laos has emerged as a small but growing supplier. Public, country-specific official forecasts for Laos’ 2025/26 sugar output are scarce but trade data shows sugar exports worth about US$273 million in 2023, mainly to Vietnam and China, with growth continuing in 2025. Though absolute tonnages are small, Laos is strengthening its presence as a niche certified origin.

What this means for buyers is Laos represents a new supplementary origin. Logistics usually move through Vietnam or Thailand. However, without robust official statistics, procurement teams should validate volumes directly with suppliers on a shipment-by-shipment basis.

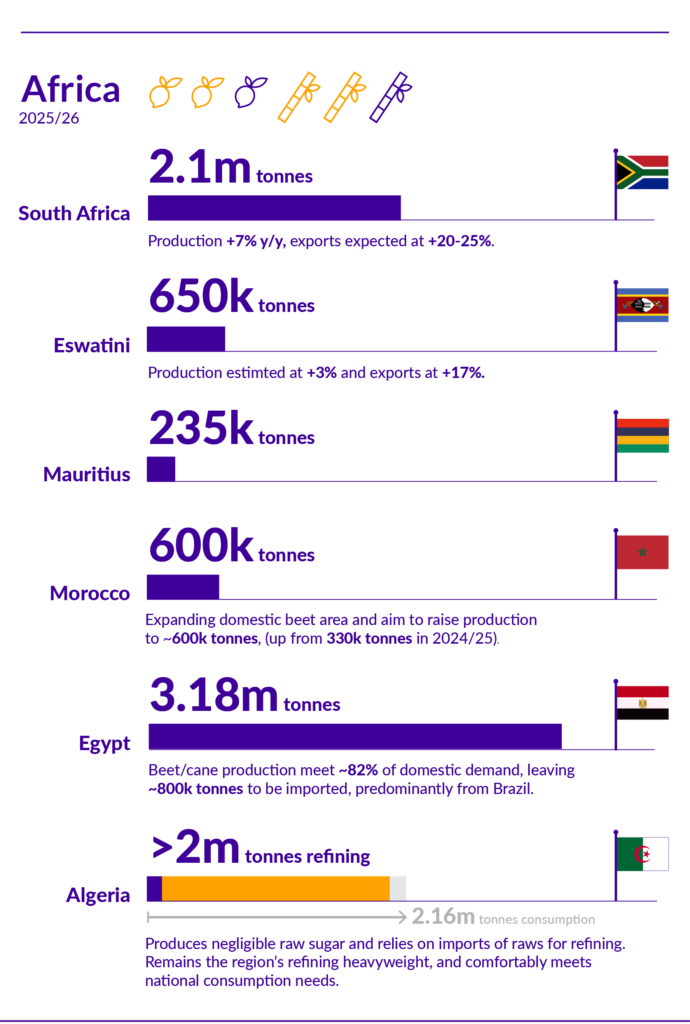

Across Africa, conditions are mixed but broadly improving.

South Africa is forecast to recover to 2.1 million tonnes in 2025/26 (+7 % y/y) following normal rainfall. Exports are expected to rise by as much as 20-25 % as stocks rebuild. Exports are recovering after the 2023 logistics backlog, though profitability remains constrained by high transport costs. Energy costs also remain a drag on margins, but a larger crop loosens the regional balance and supports export programmes into the Southern African Customs Union (SACU) and the EU/UK.

Neighbouring Eswatini should see production up 3% with exports up 17%, helped by strong EU and UK demand. It remains a dependable origin for refiners seeking Southern African supply diversity.

Mauritius maintains output around 235–250,000 tonnes, and these overall volumes remain constrained by land and yield. Planter supports introduced in the country’s 2025/26 Budget secure cane supply and keep the island’s high-value segment steady.

Government and industry communications around the 2024–25 crop pointed to roughly 2.8 million tonnes of cane and “at least” 250,000 tonnes of sugar, with a Statistics Mauritius series placing recent annual sugar output in the 230–240 thousand tonne range. Expect 2025 to stay within that quarter-million-tonne corridor assuming no major weather shocks

Further north, Morocco is expanding domestic beet area (targeting 68,500 ha) and aims to raise production toward 600,000 tonnes by 2026, up from about 330,000 tonnes in 2024/25.

Morocco remains drought-exposed, with broader crop imports supported by state policy; the government’s extension of wheat import subsidies through end-2025 underlines ongoing water stress across agriculture: drought risk is a headwind for beet.

Taken together, with consumption of roughly 1 million tonnes, Morocco should still be a net sugar importer in 2025/26, with domestic output meeting only a portion of demand while refinery throughput and imports bridge the gap.

In Egypt, 2025/26 production is forecast at 3.18 million tonnes, of which 2.47 million tonnes is beet sugar and 0.71 million tonnes from cane. This is compared to 2.6 million tonnes produced in 2024/25 Beet and cane production together meet around 82% of domestic demand, leaving roughly 800,000 tonnes for import predominantly from Brazil. North African consumption continues to grow slowly, tracking population trends.

Algeria produces negligible raw sugar and relies on imports of raws for refining. Its consumption is high for North Africa, at about 2.164 million tonnes. Yet Algeria remains the region’s refining heavyweight. Modern refining capacity of >2 million tonnes annual capacity comfortably meets national needs of about 2.1 million tonnes and occasionally generates an exportable surplus. Algeria’s demand for raws therefore stays firm, anchoring North African import volumes.

African producers are stabilising after weather-related dips. The combination of strong Southern African output and consistent North African refining throughput reinforces supply security for the region, though domestic energy and freight costs still influence delivered prices.

Consistent output and trade access strengthen Australia’s role in global supply

Australia’s 2025 crush has been smoother than the weather-affected 2024 season. Output is steady at around 3.9 million tonnes, with exports near 3.1 million tonnes. For UK buyers, the A-UKFTA (Australia-UK Free Trade Agreement) continues to provide valuable duty-free access and rising quota volumes are gradually strengthening trade links between the two countries.

USA and Mexico: North American producers maintain stable supply through 2026

The US is forecast to produce 8.6 million tonnes of sugar in 2025/26, split roughly 4.8 million tonnes beet and 3.8 million tonnes cane. Domestic demand is steady and stocks remain comfortable.

In Mexico, output is expected to increase modestly to 5.4 million tonnes, keeping trade flows with the US balanced under the USMCA framework. The USDA’s latest Sugar and Sweeteners Outlook highlights sufficient regional supply through the next marketing year, with minor adjustments to Mexico-to-US allocations following weather-related delays.

What does all this mean for European sugar buyers?

The global sugar market is now well supplied. With production at near-record levels in Brazil, India, and Thailand, and stable exports from Australia and South Africa, buyers are enjoying a rare window of favourable pricing.

However, volatility risks remain. Any sharp rebound in oil prices could swing the ethanol parity and tighten supply; India’s export policy and the pace of Brazil’s late-season crush will shape sentiment into early 2026. Within Europe, higher logistics and energy costs still create regional premiums even when world prices fall.

Sources include:

Our expert sourcing team, who are immersed in the global sugar supply chain daily, USDA Foreign Agricultural Service Country Reports (May–Sep 2025); USDA World Markets and Trade (May 2025); International Sugar Organization (Aug 2025); European Commission Sugar Market Observatory; UNICA bi-weekly data; British Sugar campaign updates; UK Government ATQ and A-UKFTA notices; Reuters and Bloomberg market coverage (Aug–Oct 2025).

Ragus responsibly sources raw and refined cane and beet sugars from approved suppliers around the world and manufactures functional pure sugar ingredients for industrial food and beverage applications globally. To learn more about our pure sugars, contact our Customer Services Team. For more sugar news and updates, keep browsing Sugar Talk and follow Ragus on LinkedIn.

Ben Eastick

A board member and co-leader of the business, Ben is responsible for our marketing strategy and its execution by the agency team he leads and is the guardian of our corporate brand vision. He also manages key customers and distributors.

In 2005, he took on the role of globally sourcing our ‘speciality sugars’. With his background in laboratory product testing and following three decades of supplier visits, his expertise means we get high quality, consistent and reliable raw materials from ethical sources.