Sugar Talk

Sugar Talk

Tariffs on sugars explained: what sugar buyers need to know

Sugar is a critical ingredient in the global food industry, with most countries and global trading blocs controlling prices and protecting their domestic sugar industries through tariffs, duties and rules of origin. In this article, we breakdown sugar tariffs related to UK supply and the impact of major trade agreements.

What are tariffs?

Tariffs are taxes imposed on the flow of trade between countries. The World Trade Organization (WTO) defines tariffs as ‘customs duties on merchandise imports’, so duties and customs duties are other words used for tariffs, particularly in the global sugar market. Originally designed as a source of government revenue, tariffs are now used primarily to protect a domestic or local industry from competition. If a locally produced raw material is cheaper because the same imported raw material has tariffs applied, then buyers choose the local supplier – that’s the theory. For example, the European Union (EU) uses duties on sugar imported from outside the trade bloc to protect sugar beet farmers and sugar producers in the member states.

Tariffs are applied in different ways:

– Ad valorem tariffs are where duty is calculated using a percentage of the import’s value, for example ‘add a 10% duty to the sugar’s price’.

– Specific tariffs are based on a fixed amount per unit of the imported goods. This approach, alongside quotas (see below) is common in global sugar markets. The UK, for example, levies a duty of £280 / €339 per tonne on some sugar imports.

– Tariff-rate quotas (TRQs) work by applying a zero or lower tariff rate on import quantities up to a certain amount, or quota. A higher tariff is applied to import quantities over that quota. This is typically how the global sugar market works.

Some tariffs, usually aligned with quality standards, can work well to protect a domestic industry. However, when not fully thought through or if weaponised tariffs end up distorting markets and increasing prices for businesses and consumers. And when trading partners act in response to a newly introduced tariff, the resulting costs and uncertainties – or even trade wars – can cause serious economic damage.

Depending on the origin, type and destination of sugar imports and exports, sugar duties can have a major impact on sugar product cost structures and play a major role in the final ingredients’ costs and availability. Ragus sources primary cane and beet sugars from approved suppliers in Africa, the Asia Pacific, the Caribbean, Europe and South America. Our sourcing expertise ensures we provide our customers with continuity of supply.

What are the tariffs on UK sugar imports?

Following Brexit, the full effects of which came into force on 31 January 2020, the UK has its own tariff structure outside of the EU’s Common External Tariff, called the UK Global Tariff (UKGT). It retains some of the original EU tariff frameworks, but important changes have been introduced. UKGT duties on sugar imports depend on the:

– Type of sugar being imported: raw, refined, or white.

– Intended use of the imported sugar: refining or direct consumption.

– Country of origin of the imported sugar and any preferential trade agreements in place.

Specifically, UK sugar buyers and importers must consider:

General Tariffs: Raw cane sugar imported into the UK from countries without a specific trade agreement, called non-preferential countries or in WTO-speak, Most Favoured Nations (MFN – see below), attracts a tariff of £280 / €339 per tonne for sugar intended for refining and £350 /€419 per tonne for refined white sugar intended for direct consumption. These tariffs are in place to protect the UK beet farming and refining industries.

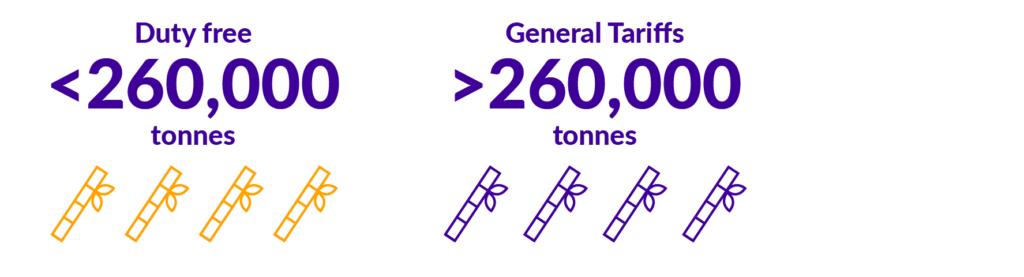

Autonomous Tariff Quotas (ATQs): ATQs allow a specific and limited quota of raw cane sugar to be imported tariff-free from any country on a first-come first-served basis. The current duty-free quota is 260,000 tonnes of raw cane sugar. If imports are within the quota, ATQs enable importers to source lower cost sugar. Once the quota is used up, the General Tariffs apply.

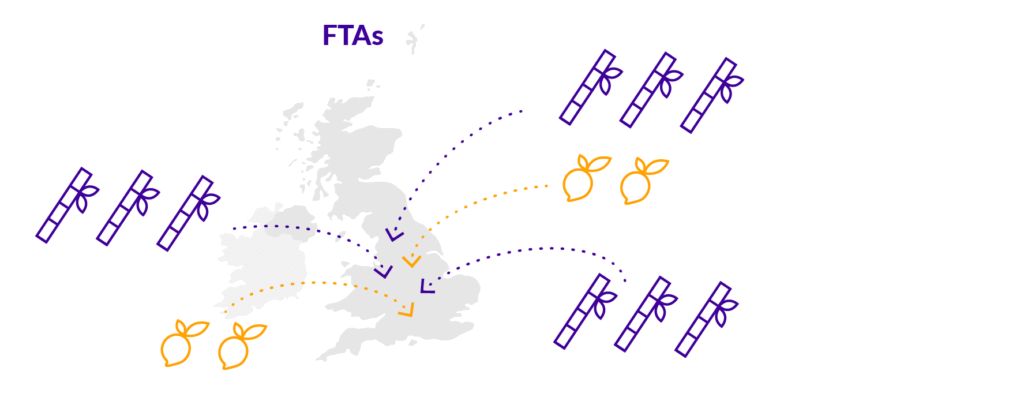

Preferential Trade Agreements: Since Brexit, the UK can negotiate its own trading relationships with sugar producing countries. Some of these Free Trade Agreements (FTAs are covered below) include terms that significantly reduce or eliminate tariffs for sugar sourced from countries covered by the FTA.

Most Favoured Nation (MFN) is a WTO concept that essentially means all members of the WTO are treated the same. In practice, for sugar, this means any country not covered by a free trade agreement (FTA) is an MFN.

There are additional complexities. Preferential duties apply to sugar imports from specific countries according to Economic Partnership Agreements (EPAs) and other trade agreements. Least Developed Countries (LDCs – as defined by the United Nations and WTO) from African, Caribbean and Pacific states (ACP) like Malawi and Mozambique can import raw cane sugar tariff-free under the UK’s Generalised Scheme of Preferences (GSP). The UK and EU imported 1.25m tonnes of sugar in 2024/25, mostly raw cane sugars.

What are the tariffs on exporting sugar from the UK to the EU?

According to the EU, once the UK left EU Customs Union and Single Market, it is now a third country. This means sugar imported into EU member states from the UK is subject to the EU’s Common External Tariff (CET) and full WTO MFN tariffs, unless there is a specific agreement that says otherwise. For third countries including the UK, the EU’s raw cane sugar for refining tariff is €339 per tonne. For refined sugar that is for direct consumption, it increases to €419 per tonne.

However, UK-EU Trade and Cooperation Agreement (TCA) does aim for tariff-free trade in most goods if they meet Rules of Origin. Sugar originating entirely in the UK, or sufficiently transformed into a new ingredient, can qualify for zero tariffs when exported to the EU. But this is a complex process for ingredients that include imported raw sugar which are being refined or manufactured in the UK and then re-exported to the EU. If the origin is not considered as fully UK, the CET will apply – only UK beet sugar is duty free.

Do FTAs impact on sugar tariffs?

During 2024 and 2025, several significant formal Free Trade Agreements (FTAs) and new trade deals were finalised, and some signed, by the UK, and at the time of writing the possibility of a new relationship with the EU is being negotiated. Here are the major trade deals and their impact on sugar imports:

The US-UK Trade Relationship

Despite media reports during May 2025, there is no formal comprehensive UK-US FTA and sugar imports and exports are still subject to WTO rules. There are tough US quotas and conditions on sugar imports to protect the domestic industry and the UK reciprocates, applying standard MFN tariffs on US sugar imports. There have been no significant changes to the UK-US sugar trade, yet.

The UK-India Free Trade Agreement (FTA)

Whilst negotiations for a UK-India FTA concluded in early May 2025 that will benefit many industry sectors, both nations initially agreed to exclude sugar from any FTA to protect their domestic sugar industries. India is one of the world’s largest sugar producers, but its sugar imports are above the ATQ quota. But there remains scope for agreement over preferential quotas or reduced tariffs, which could lead to more cost-effective sugar sourcing from the UK.

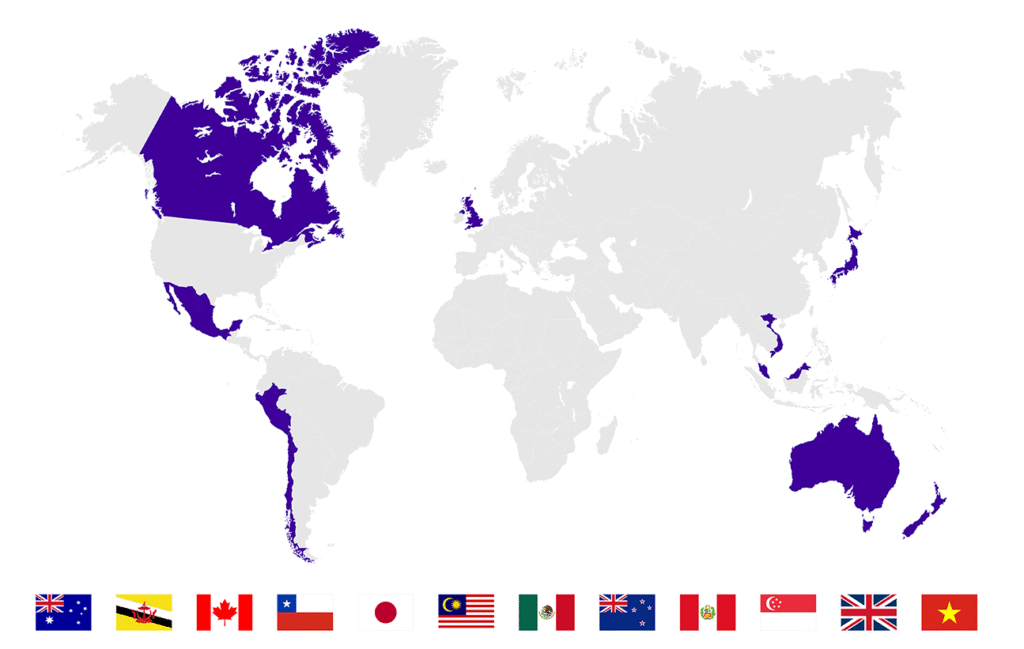

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP)

The UK joined the CPTPP in 2023, and the agreement came into force for most of its 12 members on 15 December 2024. Despite the overall scope and opportunities offered by this FTA, the impact on sugar imports and exports will be limited in the short term. Some signatories have protectionist policies to protect domestic markets. However, there will be opportunities for lower tariff or tariff free raw sugar imports from Asia Pacific producers.

Many of our industrial ingredients are manufactured from cane sugar and molasses. These ingredients can only be derived from sugarcane, which grows in tropical or subtropical regions. Our knowledge of the sugar market and global sourcing, including tariffs on sugars, ensures we can supply our customers with the highest quality pure sugar formulations on time, to specification and in full.

We manage the complexities of responsibly sourcing the highest quality sugars for the industrial ingredients we supply to our food and beverage customers. To learn more about how we manage your supply chain risk, contact our Customer Services Team. For more sugar news and updates, continue browsing SUGARTALK and follow Ragus on LinkedIn.

Ben Eastick

A board member and co-leader of the business, Ben is responsible for our marketing strategy and its execution by the agency team he leads and is the guardian of our corporate brand vision. He also manages key customers and distributors.

In 2005, he took on the role of globally sourcing our ‘speciality sugars’. With his background in laboratory product testing and following three decades of supplier visits, his expertise means we get high quality, consistent and reliable raw materials from ethical sources.